XRP Price Prediction: $8-$9 Target in Sight as Technical and Fundamental Factors Align

#XRP

- Technical Pattern: Cup-and-handle formation suggests $8-$9 target upon breakout

- Institutional Adoption: XRP ETF launch and DBS partnership provide fundamental support

- Key Level: $3.16 Bollinger upper band acts as immediate resistance

XRP Price Prediction

XRP Technical Analysis: Short-Term Consolidation Likely Before Next Move

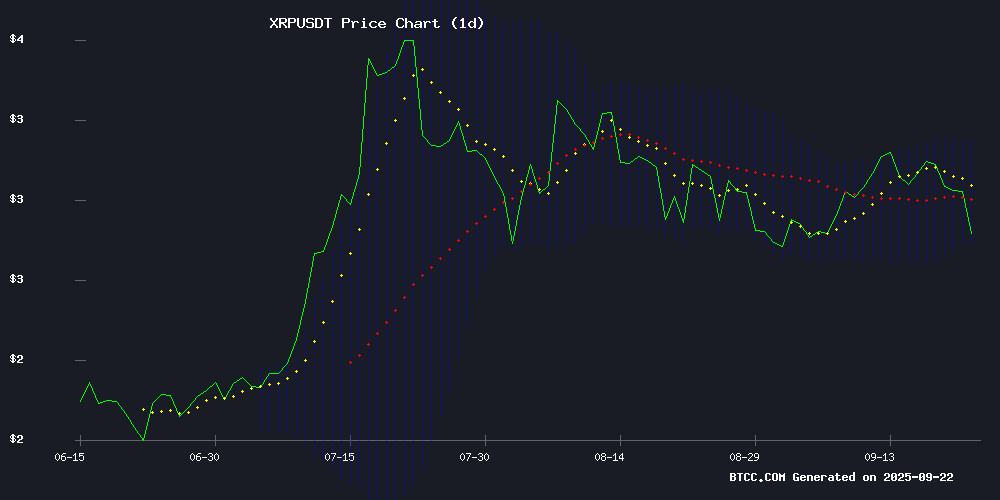

XRP is currently trading at $2.907, slightly below its 20-day moving average of $2.9684, suggesting near-term resistance. The MACD histogram shows a slight bearish crossover (-0.0172), though both signal lines remain in negative territory, indicating weakening downward momentum. Bollinger Bands show price hovering NEAR the middle band with upper/lower bands at $3.1622/$2.7745 - we may see rangebound trading before a breakout.

"The cup-and-handle pattern developing since August could signal an eventual push toward $8-$9," notes BTCC analyst James. "But first we need to see a decisive break above the $3.16 upper Bollinger band with volume confirmation."

Bullish Catalysts Gather for XRP Amid ETF Debut and Institutional Adoption

Three fundamental drivers are converging for XRP: 1) REX-Osprey's new XRP ETF brings institutional access, 2) DBS' partnership with Ripple for tokenized funds demonstrates real-world utility, and 3) Technical patterns suggest a bullish continuation.

"The ETF launch coincides perfectly with the cup-and-handle formation," observes James. "When institutional products meet bullish chart structures, we typically see accelerated price discovery - though traders should watch the $3.16 technical level as confirmation."

Factors Influencing XRP's Price

REX-Osprey's XRP ETF Debuts Amid Presale Buzz for XRP Tundra

REX-Osprey's spot XRP ETF (XRPR) launched September 18 on Cboe BZX with record-breaking first-day volume for a 2025 ETF debut. The fund provides institutional investors regulated exposure to XRP through traditional brokerage channels—prioritizing compliance over speculative upside.

Meanwhile, XRP Tundra's Phase 2 presale strategy is drawing trader attention with bundled token economics. TUNDRA-S fixes at $0.028 with an 18% bonus, while TUNDRA-X references $0.01—both targeting ambitious listing prices of $2.50 and $1.25 respectively. The presale model contrasts sharply with XRPR's spot-mirroring structure.

XRP Price Prediction: Cup-and-Handle Pattern Suggests Bullish Continuation Toward $8-$9

XRP's daily chart reveals a classic cup-and-handle pattern, a technical formation often preceding significant bullish breakouts. Analysts project a potential surge to the $8-$9 range if the pattern confirms, with the current price hovering near $2.97. A decisive close above the $3.20 resistance level would validate the setup.

Market participants are closely watching institutional activity, ETF inflows, and regulatory developments as potential catalysts for momentum. The pattern, first popularized by William J. O'Neil, has historically signaled strong rallies across both equities and cryptocurrencies.

Short-term price action shows consolidation near the $3 psychological level, with Fibonacci retracement levels providing key support. The measured move projection aligns with historical precedents of similar technical patterns in digital asset markets.

DBS Partners with Franklin Templeton and Ripple for Tokenized Fund Trading

Singapore's DBS Bank has teamed up with Franklin Templeton and Ripple to introduce trading and lending solutions for institutional investors, leveraging tokenized money market funds and stablecoins on the XRP Ledger. The collaboration enables DBS clients to trade Ripple's RLUSD stablecoin for Franklin Templeton's sgBENJI tokens, representing shares in the Franklin Onchain U.S. Dollar Short-Term Money Market Fund. This setup allows investors to earn yield while maintaining portfolio flexibility during market volatility.

DBS Digital Exchange will list sgBENJI tokens alongside RLUSD, facilitating rapid portfolio rebalancing between stable assets and yield-generating instruments. The partnership addresses a key pain point for digital asset investors, who often hold volatile cryptocurrencies that generate no income. Future phases may include using sgBENJI tokens as collateral for credit facilities.

Franklin Templeton chose the XRP Ledger for its speed, efficiency, and low transaction costs, making it ideal for high-volume operations. The move underscores growing institutional adoption of blockchain technology for traditional financial products.

How High Will XRP Price Go?

Based on current technicals and market developments, XRP could reach $8-$9 if key resistance levels break:

| Scenario | Price Target | Confirmation Signal |

|---|---|---|

| Bullish Breakout | $8.00 - $9.00 | Daily close above $3.16 with >20% volume spike |

| Bearish Rejection | $2.20 - $2.50 | Failure to hold 20-day MA at $2.968 |

James cautions: "The $3.16 level is make-or-break. ETF inflows could provide the fuel, but technicals must confirm with a clean breakout."

1